The State of Foreclosure in New York State

At the writing of this article, there are 33,764 foreclosures pending in New York State alone. With New Jersey leading the nation in foreclosure actions and Pennsylvania following not far behind, foreclosure proceedings continue to represent a disproportionate share of pending cases across the country. Although new foreclosure filings are trending downward from record highs following the mortgage crisis and recession, foreclosure calendars in courts continue to be among the busiest.

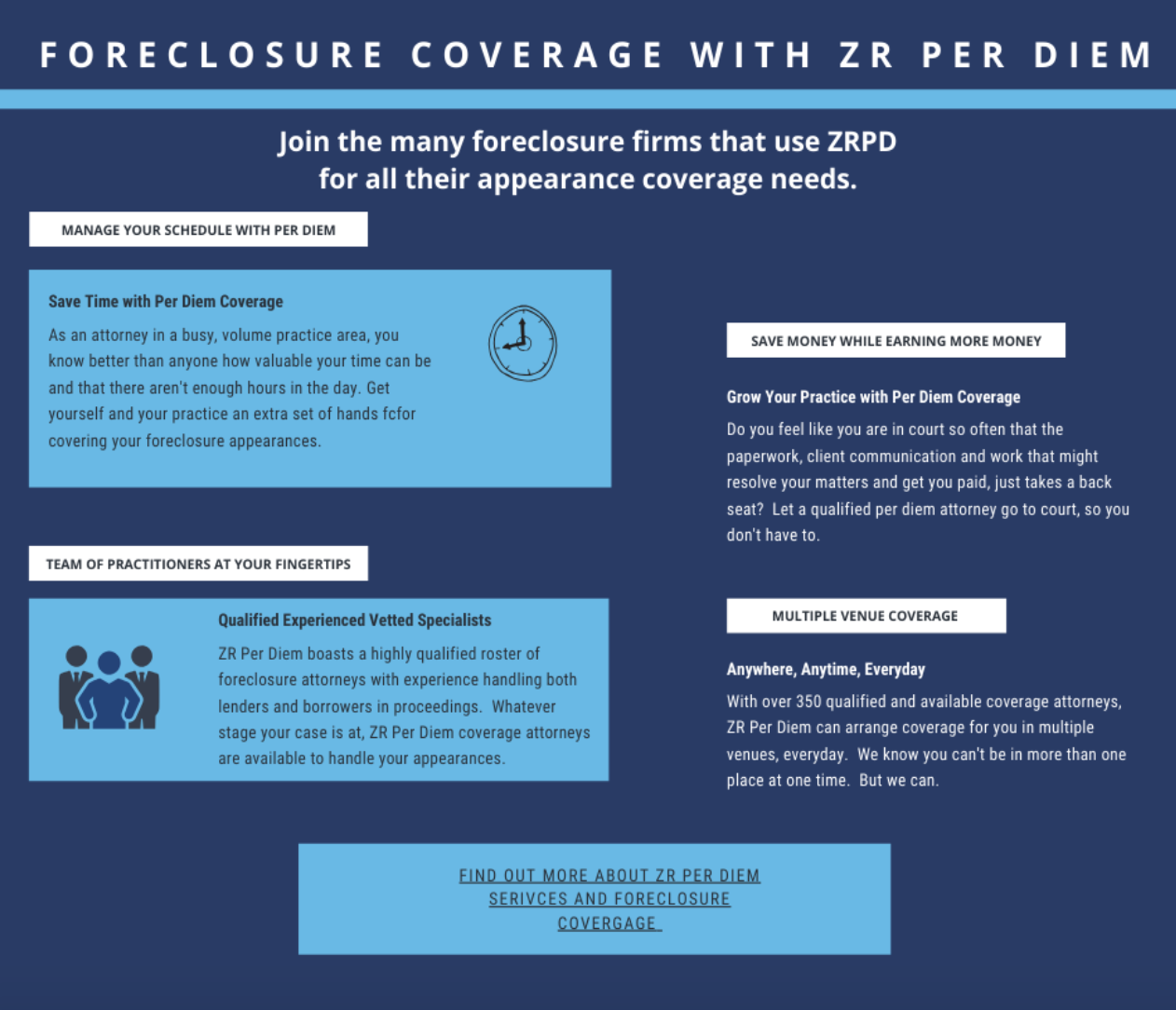

Foreclosure cases are big business for lawyers representing lenders and borrowers, alike and most firms handling foreclosure proceedings for both sides are volume business. ZR Per Diem Services works with many practitioners with volume caseloads who need to make time to make money. Volume practices require the right tools to be profitable and effective. The use of coverage attorneys is just one tool available to volume practitioners like those who handle foreclosure proceedings. Even with the latest strategies for managing the foreclosure caseload, practitioners still need to keep up with the court changes, managing the changing needs of their clients, amidst these strategies and new policies. Partnering with a per diem services provider helps to fill the gap many practitioners find when trying to balance their busy calendars.

A contributing factor to the challenges to managing a volume foreclosure practice are judicial reforms designed to reduce the burden of the significant increase in foreclosure cases at the height of the mortgage crisis. These judicial reforms, which may cause drawn-out proceedings and unexpected changes in the requirements to pursuing or defending foreclosure proceedings, require strict adherence to sometimes complicated procedural requirements for both lenders and borrowers. Some of the reforms may have even caused cases to stall. Other reforms have been instituted to better manage foreclosure cases more efficiently or reducing the backlog of cases by changing court policies. Reforms such as:

- Creating specialized foreclosure parts. In New York these are called FSP parts. (Foreclosure Settlement Parts).

- Specialized abandoned and vacant property parts; (Often referred to as Zombie Properties)

- Requiring bank representatives to have the authority to engage in meaningful settlement negotiations with borrowers.

- Standardized forms to ensure practices are clear and consistent across jurisdictions;

- Improved case tracking;

Foreclosure cases make up a significant share of New York’s Supreme Court civil caseload, although the share is falling as new filings drop and pending cases are resolved. Foreclosure proceedings still represent eighteen percent of pending matters (18 percent). Part of the reduction in the foreclosure caseload could be due to changes in the housing market and the broader economy. Tighter lending standards have also decreased the likelihood of mortgage defaults while increasing home values improves the likelihood that a homeowner can avoid foreclosure by selling the property.

Even with the downturn in newly filed foreclosure proceedings, the numbers remain staggering.

Cases, on average, can remain in the Foreclosure Settlement Part for up to two years, depending on the specific facts of the case. Failure to appear for a conference scheduled in FSP can result in the case being “released” to the trial part (In most NYC area courts) which can expedite the foreclosure process. This can be detrimental to the defense of an action. Likewise, the failure to appear on behalf of the lender often results in dismissal of the claim and protracted litigation to resolve the delinquent loan.

When the parties appear at an FSP conference, the referee will ask both sides a series of questions, like specifics about the loan in questions, the process followed by the lender in bringing the proceedings, what defenses the borrower believes he or she has a defense to the proceeding, whether the borrower resides in the premises or it is an investment property and specifics about the borrower’s income and assets. Based upon this conference with the court, the parties will discuss possible resolutions like a loan modification, relinquishment of the property or a short sale to sell the property and pay off the loan.

It is important for clients to understand that just because a Notice of Delinquency has been served doesn’t mean the house is going to be lost. There are options available to clients who are delinquent on their mortgage payments and methods that can be used to manage or slow down the process. Most important is to have a representative who understands the clients options and knows the process that will be followed in court.

Likewise for lender representatives, the landscape of foreclosure law has been changing. The need to have a qualified attorney handling appearances has never been more important. Courts take foreclosure proceedings, which are attempting to result in someone potentially losing their home very seriously. There are stringent procedural requirements, including requirements that the lender advise the borrower of loss mitigation requirements and notice requirements before a proceeding is brought. Failing to have knowledgeable representation before the court who can explain how each of the requirements were complied with and understands the nuances of the specific procedures can result in unnecessary delay or dismissal of your action.

Lawyers assigned to cover appearances on behalf of ZR Per Diem Services clients understand foreclosure proceedings. They know the courts and the rules specific to each county. They know the nuances of the law and can advocate for your position so that your matters do not languish and your case can proceed smoothly to the desired outcome.

What to Expect when ZR Per Diem provides coverage for your Foreclosure Matter:

- Experienced attorneys assigned to handle your matter;

- Personalized attention to the details of your case;

- Advocacy of your position;

- Contact from the assigned attorney should the appearance not go as expected or if the court has questions that need to be answered;

- A Professional representative to meet with your clients, should you represent the borrowers in the case;

- Experienced communication with the borrower and the court where your practice involved lender representation;

- A complete and detailed report of what transpired in your matter;

- The ability to request coverage, at the touch of a button, on all follow up conferences and hearings;

- Competitive rates for court appearance coverage.

Trust ZR Per Diem Services highly qualified and experienced foreclosure covering attorneys to help you manage your busy calendar, whether your office represents lenders or borrowers.

To learn more about ZR Per Diem foreclosure coverage services see our page dedicated to foreclosure law in New York, New Jersey and Pennsylvania. (add link)

To book foreclosure coverage now,